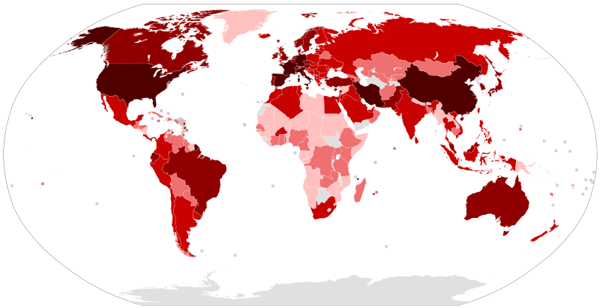

On 11th March 2020, the World Health Organization (WHO) declared the COVID-19 outbreak a pandemic. At the time of writing, hundreds of thousands of lives and businesses have been affected. With multiple countries issuing bans on travel across borders and ordering shutdowns of cities and towns, many businesses are seeing the virus take its toll.

On 11th March 2020, the World Health Organization (WHO) declared the COVID-19 outbreak a pandemic. At the time of writing, hundreds of thousands of lives and businesses have been affected. With multiple countries issuing bans on travel across borders and ordering shutdowns of cities and towns, many businesses are seeing the virus take its toll.

According to economists and financial experts from ING Think, the drop in tourism in Asia due to the virus could cost the region $115 billion this year. And, as the pandemic continues to spread, travel to and from affected countries will undoubtedly be reduced further, disrupting nations that rely heavily on travel.

As for the retail industry, a recent survey found that sales in China fell 20.5% in the first two months of 2020. As of March 2020, 85% of internet users in China claimed to have avoided public places in the past two weeks, which means that retail sales could potentially fall even further in these unprecedented times.

The Ingenico team in the Asia-Pacific (APAC) region has experienced firsthand how many have been impacted by the COVID-19 pandemic. We have observed the pandemic unfold up close and have learnt to adapt to the evolving situation of COVID-19 and help businesses take appropriate measures in these difficult times.

The question for merchants in other parts of the world, particularly cross-border merchants, is what precautionary measures they can learn from counterparts across China and Asia Pacific (APAC) to limit the business risks of COVID-19? Here are our learnings.

Risk I – Soaring refunds

Due to multiple travel bans imposed by governments and airlines, businesses in the travel industry are bound to see a spike in refund numbers over the next months. This number will be accelerated by growing public fears and the reluctance of would-be travelers to book flights or tours. The retail industry will also see more cancellations and refunds, as the impact of COVID-19 on logistics, transportation and shipping creates stock shortfalls.

To maintain good merchant-consumer relationships, we advise retail merchants to make refunds within 30 days of purchase. For travel merchants, it is important that customers understand your refund policy and you assist them in order to prevent chargebacks. To ensure consistency throughout this period, it is paramount to review the refund process with your payment service provider, estimate the total refund amounts you would expect, and prepare cash reserves to make up for the funding shortfall. In Asia, Ingenico has been working closely with merchants to support them with the surge in refunds, ensuring that end-customers receive refunds without delay. We also use an automated reporting system, which reduces the burden of reconciliation for our merchants.

Risk II – Entering into a chargeback program

Card scheme chargeback ratios are measured against sales every month. If sales are declining, chargeback ratios are likely to rise as the chargebacks roll in from previous months. In retail, a slowdown of the global supply chain and stock shortages can also create the risk of unnecessary chargebacks as delivery timeframes are pushed out, resulting in unhappy customers. Combined with a drop in sales, it is far easier for merchants to breach the threshold where card schemes enact penalties – 0.9% for Visa and 1.5% for MasterCard with a minimum of 100 chargeback transactions. Visa issued a statement clarifying its adjusted policies during the pandemic (and MasterCard followed suit).

Retail merchants should keep a close eye on chargebacks and take prompt actions to optimize their listings – for example, removing out-of-stock items in a timely manner and training customer service teams to explain supply shortages to customers whilst giving service teams the flexibility to refund when necessary.

At Ingenico, we have assigned dedicated and knowledgeable fraud managers to provide tailor-made services – monitoring merchants’ chargeback rates daily and altering their fraud management processes when the rate is too close to the threshold. If chargebacks have increased purely due to factors related to the virus outbreak, we will help our merchants prepare the documents to appeal for a penalty waiver from the card schemes.

Risk III – Cash flow problems

Thus far, the virus outbreak has greatly impacted consumers’ willingness to spend and the global supply chain. Many merchants have already experienced a huge dip in sales and profits, especially when strict controls have been implemented – for example, a nationwide lockdown or travel ban. As a result, merchants in some countries may experience a severe drop in cash flow and could ultimately face bankruptcy.

To ensure that merchants are protected, they now need to consider how to shorten the settlement cycle while reducing the cost of payment processing. Ingenico can provide merchants with daily settlements to ensure their liquidity. We have also helped many to reduce deposit requirements and costs and to optimize conversion rates by adapting to local preferred payment methods.

Risk IV – Sharp movements in the Foreign Exchange (FX) market

Outbreaks in countries such as China, Italy and the United States have caused dramatic falls in global stock prices and bond yields. Also experiencing extremely high volatility is the foreign exchange market, with currencies fluctuating in value significantly from day to day and therefore severely impacting the value of overseas receipts in foreign currency. It is a difficult time for merchants and other stakeholders to set the right prices for cross-border commerce.

In order to tackle this, we suggest that all merchants seek FX Guarantee services from their payment service provider, or reputable financial institutions, to lower the FX risk. We have been providing FX Guarantee services to our merchants along with multi-currency pricing (MCP) solutions to minimize currency-induced friction, reduce shopping cart abandonments and allow merchants to profit from smart currency pricing strategies.

Working together

We have already seen signs of recovery from within our portfolio in China, with sales starting to rise in both retail and travel segments. As the global spread of COVID-19 continues, we will continue to work with our merchants to implement solutions that mitigate the impact of this rapidly changing situation. Ultimately, in the face of extraordinary circumstances, merchants, payment service providers and other financial institutions must all work together to minimize the impact on us all. Together we will find a way to overcome the unprecedented pressures placed on the global economy.

For resources on how your business can navigate any challenges discussed in this blog, please visit: ingenico.com/global-epayments.

Nathan Salisbury is General Manager, Asia Pacific at Ingenico ePayments